Information on tax-free ordering with a VAT number (B2B)

Prerequisite for net delivery within the EU

- this procedure applies exclusively to companies with a registered office within the European Union

- the delivery must be made to the company address outside Germany

- a valid VAT number must be entered when placing the order

- this UID number must be deposited in the VAT Information Exchange System of the European Commission VIES and be verifiable by us.

Reservation of recognition by us

- We expressly reserve the right to refuse a net delivery if we have doubts about the legality, validity or the suspicion of misuse!

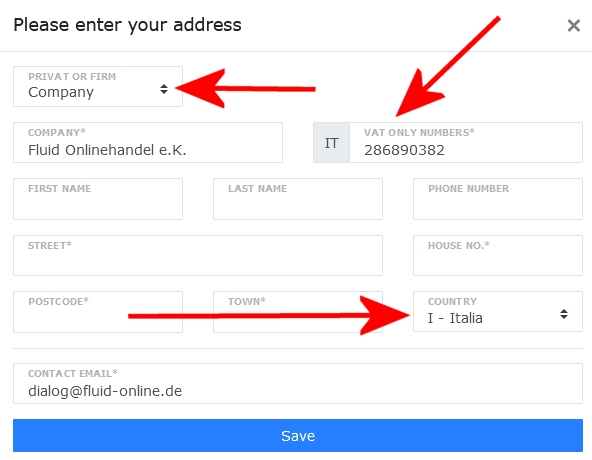

Enter the VAT number:

- In the registration process, select "Company" in the "privat or firm" field.

- then the input field "USTID - only number" opens additionally

- Enter the valid UID number of the company WITHOUT the country code in this field.